How To Setup a Tax Advisory Practice

Introduction

Welcome to Falcon Enterprise, your trusted partner in business and consumer services. In this comprehensive guide, we will walk you through the process of setting up a tax advisory practice for your accounting and tax firm, providing you with valuable insights and expert tips to ensure your success in this highly competitive industry.

1. Understanding the Tax Advisory Services Landscape

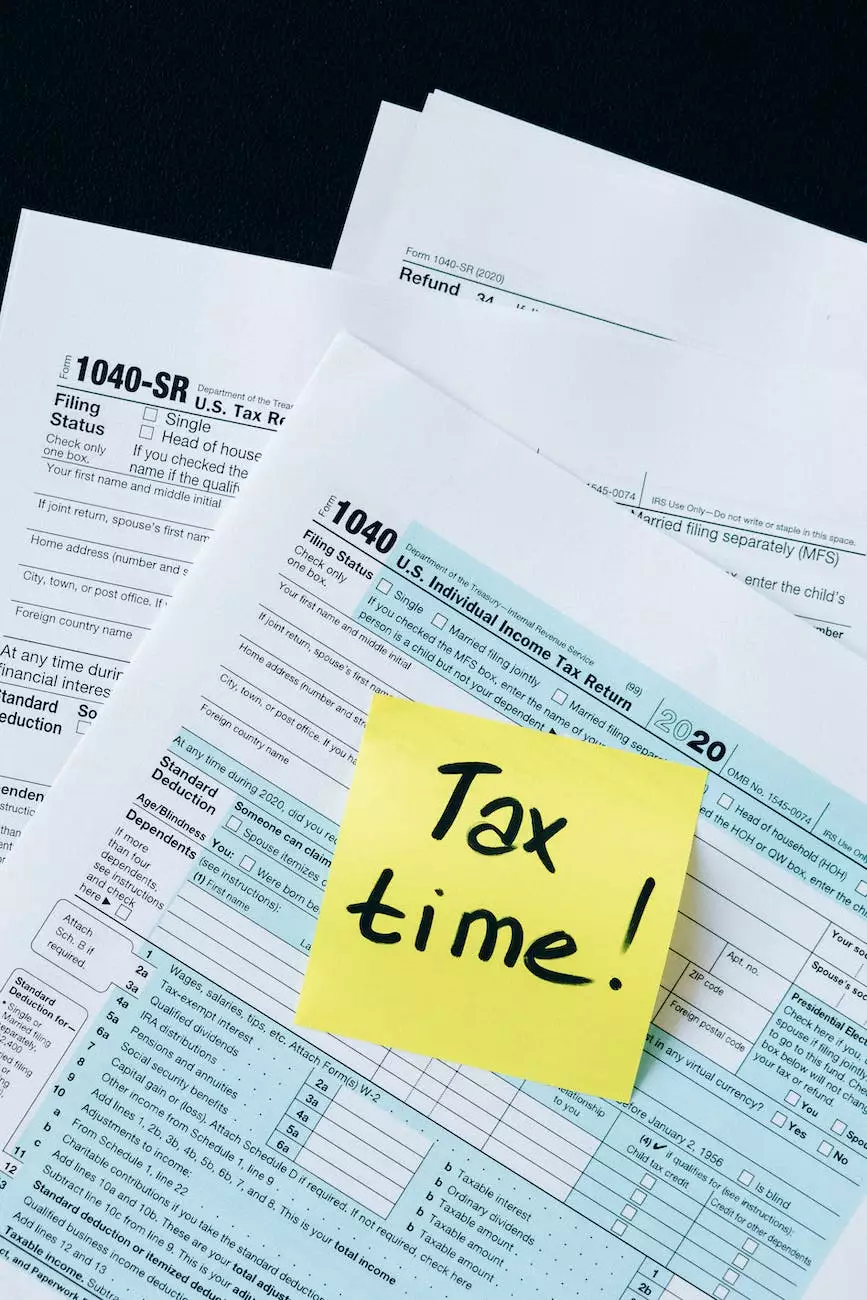

Before diving into the setup process, it's crucial to have a solid understanding of the tax advisory services landscape. Tax advisory services involve providing expert guidance and strategic planning to individuals and businesses regarding their tax obligations and optimization strategies.

In today's complex and ever-changing tax environment, taxpayers are increasingly in need of professional assistance to navigate the intricacies of tax laws and regulations. By offering tax advisory services, your accounting and tax firm can cater to this growing demand and position itself as a trusted advisor for tax-related matters.

2. Defining Your Target Market and Services

Identifying your target market and determining the specific tax advisory services you will offer are crucial steps in setting up a successful practice. Research your potential clients and their needs to tailor your services accordingly.

Consider specializing in areas such as tax planning, compliance, international taxation, or industry-specific tax consulting. This focused approach will help differentiate your firm from competitors and attract clients seeking specialized expertise.

3. Building a Strong Team

To provide top-notch tax advisory services, you need a team of highly skilled professionals. Seek individuals with expertise in tax law, accounting, and financial planning. Certification and relevant experience are also important factors to consider.

Foster a culture of continuous learning and professional development within your team. Encourage them to stay updated with the latest tax regulations and industry trends. This will ensure your firm can adapt to changes and deliver exceptional service to clients.

4. Developing a Marketing Strategy

Creating awareness and attracting clients to your tax advisory practice requires a comprehensive marketing strategy. Leverage various channels, both online and offline, to reach your target audience.

Invest in a professional website that showcases your expertise, services, and client testimonials. Optimize your website with relevant keywords, ensuring it ranks high in search engine results. Craft compelling content, such as blog posts and articles, to establish yourself as a thought leader in the industry.

5. Embracing Technology

In today's digital age, technology plays a vital role in the success of any business. Embrace tax-specific software and tools to streamline your operations and enhance client experience.

Integrate cloud-based solutions to securely store client data and collaborate effectively with your team. Utilize electronic signature platforms for seamless document signing. Stay updated on emerging technologies to stay ahead of the curve and deliver innovative solutions to your clients.

6. Providing Exceptional Client Service

Client satisfaction should be at the forefront of your tax advisory practice. Cultivate strong relationships by delivering personalized experiences and exceptional service.

Communicate with clients regularly, keeping them informed about tax-related updates and changes. Be proactive in offering tailored advice that aligns with their unique financial goals. Invest in client management systems to efficiently track interactions and provide a seamless experience.

Conclusion

Congratulations! You now have a comprehensive understanding of how to set up a tax advisory practice for your accounting and tax firm. By following these steps and leveraging Falcon Enterprise's expertise in website development, you are well on your way to outranking your competitors and becoming a leader in the tax advisory services industry.

Remember, success requires ongoing effort and dedication. Continuously adapt and refine your approach to stay ahead of changing market dynamics and emerging trends. Falcon Enterprise is here to support you every step of the way.